A short article to set us off. Previously highlighted here, it appears the EU are abating there strictness. Phnom Penh Post (May 31):

'Producers of white rice will have until September to meet the revised

threshold level of 0.01 milligrams of Tricyclazole residue per kilo of

rice, far below the current limit of 1 milligram per kilo, it said.

The previous deadline for white rice exports was June, while the December deadline for jasmine rice exports remains unchanged'.

It coincides with a recent article in Le Monde (May 29), which highlights how another chemical, atrazine, forbidden in the EU since 2004, still sees substantial production in the same EU with exports heading for countries with less scruples / less legislation. It cites the Swiss organisation Public Eye which in a recent report highlighted exports from Switzerland, France and Italy. On Switzerland:

'Switzerland is exporting atrazine and paraquat to developing countries.

The use of these herbicides, made by the Swiss-based Syngenta, has been

banned in Switzerland due to their extreme toxicity'.

And though we're drifting off-topic, I would add the following article on banana growing in Laos. Often quoted, Reuters decided to make a write up. Excerptions of which are from VOA (May 11):

'Experts say the Chinese have brought jobs and higher wages to northern

Laos, but have also drenched plantations with pesticides and other

chemicals.

...

Under the "Belt and Road" plan, China has sought to persuade

neighbors to open their markets to Chinese investors. For villagers like

Kongkaew, that meant a trade-off.

"Chinese investment has given us a better quality of life. We eat better, we live better," Kongkaew said.

But neither he nor his neighbors will work on the plantations, or

venture near them during spraying. They have stopped fishing in the

nearby river, fearing it is polluted by chemical run-off from the nearby

banana plantation.

...

Several Chinese plantation owners and managers expressed frustration

at the government ban, which forbids them from growing bananas after

their leases expire.

They said the use of chemicals was necessary, and disagreed that workers were falling ill because of them.

"If you want to farm, you have to use fertilizers and pesticides,"

said Wu Yaqiang, a site manager at a plantation owned by Jiangong

Agriculture, one of the largest Chinese banana growers in Laos.

...

Hmong and Khmu workers douse the growing plants with pesticides and

kill weeds with herbicides such as paraquat. Paraquat is banned by the

European Union and other countries including Laos, and it has been

phased out in China.

The bananas are also dunked in fungicides to preserve them for their journey to China'.

It just shows hoe the lack of a conscience is the underlying business rule with the large-scale agrochemical industry.

Stealth

With a slight upswing in the rice market, it comes as no surprise that the Phnom Penh Post (May 18) reports that big brother may well be interested in a bigger part of Cambodia's rice pie:

'China has agreed to increase its import quota for Cambodian rice to

300,000 tonnes by next year, Prime Minister Hun Sen announced yesterday

following his return from Beijing where he attended the Belt and Road

initiative summit'.

However the Khmer Times (Jun. 2) reports on the downsides on neighbouring actions:

'Cambodian

rice millers and exporters are strongly concerned that Thailand’s plan

to release 4.32 million tonnes of state rice stocks by September, driven

by a sharp surge in global rice demand, could depress prices of the

vital grain on commodity markets.

“When

Thailand sells such a large part of its stockpile on the open market it

will have a knock-on effect on prices and in turn also affect the price

of Cambodian milled rice exports,” Hun Lak, vice president of the

Cambodia Rice Federation, told Khmer Times'.

The same source (Khmer Times, Jun. 5) also delves the depths of the marketing strategy of Cambodia's rice future:

'Government task forces will meet this week to finalise a single brand under which Cambodian rice will be exported.

...

Hean

Vanhan, director-general of the general directorate of agriculture, said

registration of a single rice brand was the duty of the commerce

ministry.

Agriculture

officials said Cambodia had more than 10 varieties of fragrant rice,

and should not single out one as a single brand.

“The

CRF selected ‘Angkor Malis’ as the brand, but this is not right because

there is already a rice seed called malis,” Mr Vanhan said.

“What

the private sector wants to do is to steal foreign branding to make the

rice similar to Thailand, since the Thai Hom Mali is already famous.

“If

we use ‘Angkor Malis,’ which is specific only to Cambodian premium rice

‘malis,’ it has a different taste to Cambodian fragrant rice such as

phka romduol, phka chansensor and phka khnei.

“If

customers buy Angkor Malis one day, it may have a different taste when

they buy it in the future, even though it carries the same brand,” Mr

Vanhan said.

He

suggested that a non-specific ‘Angkor Rice,’ with the specific variety

written underneath would help clear up the confusion and prevent people

from thinking they were buying a specific rice variety when they might

be buying a different premium rice'.

Thai-tening

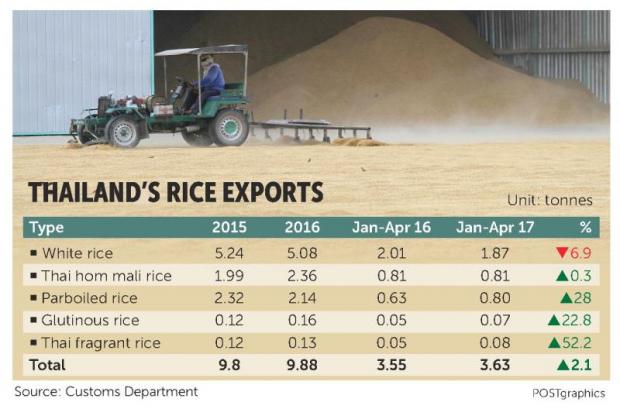

Regionally it's the Thai who are mostly optimistic. From the Bangkok Post (May 30):

'World rice prices are expected to rise by US$20 (682 baht) a tonne

over the next three months, driven by a sharp surge in global rice

demand, according to experts.

Global rice supply is now quite tight, while Thailand's previously hefty state rice stocks have eased,

releasing pressure on global rice prices, Jeremy Zwinger, chief

executive of the Rice Trader, said at the "World Rice Trade Outlook"

seminar of Thailand Rice Convention 2017, held in Bangkok yesterday.

...

Chookiat Ophaswongse, honorary president of the Thai Rice Exporter

Association, said lower-than-expected rice production in Vietnam

accounts in part for the lower global supply, while Thailand's

good-quality rice stocks are about to be depleted.

From Vietnam a similar sentiment, though more cautious. The VNexpress (May 12):

'China and several African countries have returned to Vietnam seeking

fragrant and white rice, and the demand has helped stabilize export

prices even though supply has risen at the end of a major harvest,

traders said on Friday'.

The Vientiane Times (May 5) notes that the Lao dry season rice crop may well disappoint slightly.

'This dry season, the department set a target of 95,000 hectares but

until now only about 90,000 hectares have been planted out.

Department officials said a large number of

farmers were now growing other crops instead, which earned them more

money and required less water. The lack of irrigation occurred because

provinces did not have sufficient funds to pay for the repair of

irrigation systems, according to the Department of Irrigation'.

Thailand is looking to getting rid of the last of it's inventory. The Bangkok Post (May 16):

'The government yesterday called the second auction for 1.82

million tonnes of state-held rice that is fit for human consumption.

...

The government is estimated to hold about 4.82 million tonnes of

rice stocks, a sharp drop from the 18.7 million tonnes accumulated

during 2011-14.

...

From Jan 1 to May 9, Thailand exported 4.1 million tonnes, up 9%

from the same period last year, worth US$1.74 billion (60.1 billion

baht), up 6% in value'.

An article from Vietnam.net (May 30) which looks at an interesting study:

'A study conducted by the Institute of Policy and Strategy for

Agricultural and Rural Development shows there are nine million rice

farming households nationwide, but around 300,000 of them account for

the bulk of Vietnam’s rice export volume.

Meanwhile, the nation

has over 300,000 rice milling facilities, but a majority of them are

small. But in Thailand, there are a mere 1,000 rice milling plants.

Besides, Vietnam has around 100 rice exporters, but a mere 22 of them

focus on China, one of Vietnam’s largest rice buyers.

Industry

experts said these two hindrances had led to the global market share of

Vietnamese rice shrinking. Statistics of the Ministry of Agriculture and

Rural Development show the country’s rice shipments last year dropped

27% in volume and 23% in value against 2015'.

Meanwhile, a new weapon in the armory of Italy's rice industry hoping to target cheaper rice imports from Cambodia, Burma and potentially Vietnam. From Lexology.com (May 31):

'The Italian government has submitted to Brussels the draft decrees for

the introduction of an obligation to indicate the origin of certain the

raw materials.16 For rice, the place of cultivation, processing and

packaging must be indicated, while for wheat, the place of wheat

cultivation and the sowing of the seeds must be indicated.

...

To try and counter the imports producers have been calling for better

labelling of foodstuffs containing rice so as to indicate to consumers

the true origin of the raw materials.

The producers hope that consumers will tend to purchase products with Italian rice rather than imported rice'.

It seems more as a message for domestic markets.

Measuring

Having access to the world market doesn't necessarily mean a positive. Hard work still needs to be done. The Vientiane Times (May 22):

'Although Laos is enjoying Generalised System of Preferences (GSP)

exemption from over 50 nations around the world, the country is still

unable to fully benefit from the special treatment.

The Ministry of Industry and Commerce recently

described a number of challenges Laos is facing in order to fully

benefit from trade privileges.

One of the most important points is that Lao

businesses don’t fully understand the true benefits and the various

procedures of the scheme.

In the meantime, product quality sometimes does

not meet the standard requirements as specified by countries at the

final destination.

In addition, Lao businesses produce

agricultural goods in small volumes as they are often family concerns

and have not done any market research or studied the GSP'.

'Cambodia's agricultural sector must improve post-harvest processing to

increase the value of its products, while increased knowledge sharing

could help farmers better understand the different value chains and

identify opportunities, agricultural experts participating in the Grow

Asia Forum said yesterday.

Panellists at the event, hosted by Grow Asia and held on the

sidelines of the World Economic Forum (WEF) in Phnom Penh, also said

improving farmers’ access to better seeds and inputs, as well as

training, would help them to be more productive'.

More policy talk. I think. Phnom Penh Post (Jun. 2):

'Implementation of a previously announced three-year $20 million

programme to increase local vegetable and fragrant rice production will

begin next month to help boost domestic supply and reduce imports, an

agriculture official said yesterday.

The goal of the project is to increase local production of vegetables

by 160 tonnes per day and production of 500,000 tonnes of paddy rice a

year, Kean Sophea, deputy director of the Department of Horticulture and

Subsidiary Crops at the Agricultural Ministry, said'.

And then an article from the Phnom Penh Post (May 19) highlighting how agricultural policy can develop without government fiddling:

'The Kingdom’s leading palm oil producer has projected revenues of $20

million this year as it targets another record-setting year for crude

palm oil exports.

“We plan to export over 30,000 metric tonnes of crude palm oil this

year, with revenue of approximately $20 million,” Prachak Kongtanomtham,

vice president of Mong Reththy Investment Cambodia Oil Palm Co Ltd

(MRIC), said yesterday.

MRIC, a joint venture subsidiary of local agro-industrial

conglomerate Mong Reththy Group and Thailand’s TCC Group, exported a

record 21,450 metric tonnes of crude palm oil in 2016, generating over

$13.3 million in revenue, according to Prachak.

...

About 17,000 hectares of MRIC’s palm oil plantations are harvestable.

Two other companies operate commercial palm oil plantations in

Cambodia, though only one has matured to harvest.

Malaysian-owned Virtus Green Plantations (Cambodia) operates a palm

oil plantation on a portion of its 6,700-hectare economic land

concession in Kampot province.

...

The Kingdom’s other major palm oil plantation is located in Ratanakkiri

province, where subsidiaries of Vietnam’s Hoang Anh Gia Lai have planted

oil palms on 18,000 hectares. The first harvest is expected by next

year'.

Sweetener

The Bangkok Post (May 24) reports of how Thailand seeks to meet free trade requirements while at the same time manipulating the domestic market:

'Thailand, the world's second-largest sugar exporter, is

introducing regulations to govern its sugar trading system for the

2017-18 crop, which commences in November, to bring the system in line

with World Trade Organization (WTO) rules.

...

Brazil says Thailand's subsidies for sugar producers had dragged

down global prices and allowed Thailand to win a larger market share at

the expense of Brazilian producers, conduct that is not in line with international trade agreements.

...

Traders and industry officials said freeing up domestic retail

sugar prices could lead to possible sugar shortages, particularly when

global sugar prices rise.

Traders said sugar production costs in Thailand should be slightly lower than for net sugar importing

countries.

This could encourage profiteers to smuggle sugar from Thailand to be

resold in the neighbouring CLMV countries (Cambodia, Laos,

Myanmar and Vietnam), where sugar prices are around 40% higher than domestic retail prices'.

Also hoping to dampen the local market the Bangkok Post (May 27) reports how stricter food rules will ensure that the domestic consumption will sky-rocket:

'A new bill imposing a maximum of 10% sugar or sweetener content in

food products is expected to be passed and come into effect within this

year, said the Food and Drug Administration (FDA) yesterday'.

The article also quotes EU regulation of the same subject. Though I doubt whether or not the EU has legislation on the subject, it's certainly clear that the EU sugar industry is very much opposed to any levels. Kudos to the Thai on this subject, let's hope it's an effective policy.

Then what an opener market means. The Phnom Penh Post (May 23):

'Cambodia's biggest sugar mill has finished its two-month production

run, producing half a million tonnes of refined white sugar, nearly five

times what the company predicted at the beginning of the harvest

season, a company representative said yesterday.

Kuy Yoeurn, an administrative manager for Rui Feng (Cambodia)

International Co Ltd, said the second harvest season of its $360 million

sugar plant in Preah Vihear province greatly exceeded the company’s

expectations. He said the mill produced 500,000 tonnes of refined sugar

from an undisclosed amount of raw sugarcane this season.

...

The Cambodian government granted Rui Feng Cambodia an 8,841-hectare

economic land concession (ELC) in 2011. However, the Chinese-owned

company and its four sister companies collectively hold five separate

ELC licences covering 40,000 hectares.

Rui Feng has faced accusations of land-grabbing and using its partner

firms to circumvent restrictions on the maximum legal size of land a

company can hold as an ELC.

Nevertheless, Yoeurn said Rui Feng has requested that the Ministry of

Agriculture provide the company with more land to expand its

cultivation of sugarcane.

“We need to increase our sugarcane cultivation,” he said. “So far, we

have already farmed all of our land and it is still not enough. The

ministry should provide us with more land for cultivation.”